GBP/USD Market Insight: Update On Our Previous GBP/USD Forecast

In our previous post "GBP/USD – At the Crossroads of a Complex Correction," we discussed the potential for a double zigzag to have completed.

1/5/2026

GBP/USD Elliott Wave Analysis

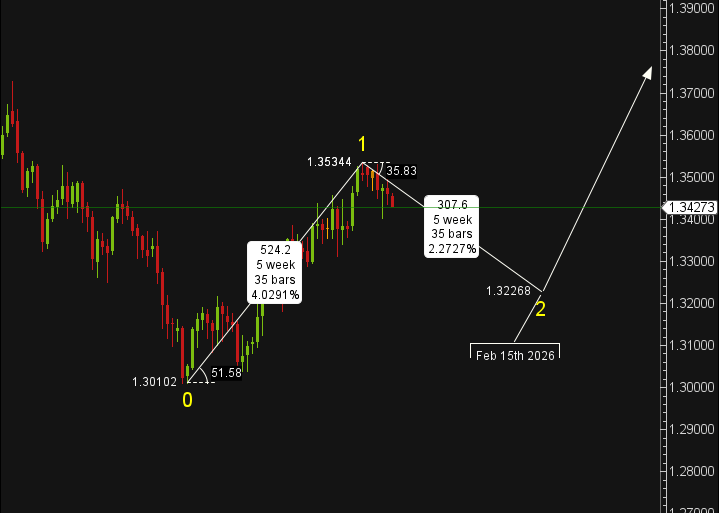

In our previous post, "GBP/USD – At the Crossroads of a Complex Correction," we discussed whether the corrective structure was complete. Since then, the GBP/USD has unfolded decisively, providing fresh structural clues and strengthening the case for a completed five-wave impulse from the November 2025 lows.

What’s Changed?

Price action has since validated a clean five-wave motive structure, with Wave 3 extending — the strongest and longest wave in the sequence — it also contained a textbook alternation:

Within this extended Wave 3 :

Wave 2 unfolded as an expanded flat (sideways corrective structure)

Wave 4 formed a zigzag correction (sharp corrective structure)

After Wave 3 completion, Wave 4 formed a triangle with the final triangle thrust completing Wave 5.

Wave 5 terminated precisely at 1.3534 — equalling Wave 1’s length, satisfying the guideline of equality when Wave 3 extends

This perfect symmetry across impulse wave relationships — including the Fibonacci alignment and alternation rule — builds confidence in a completed five-wave advance from 1.3010 to 1.3534.

Are We in Wave 2?

Zooming out to the daily chart, if this count holds, we’ve likely entered a Wave 2 correction. Based on time and price proportion guidelines:

Wave 2 should take more time to complete than Wave 1, as corrective waves often unfold more slowly than impulsive ones

This brings February 15th, 2026, into focus as a potential timeline for signs of completion after this date.

Key Technical Levels to Watch:

Support Zone:

50% retracement of Wave 1 – 1.3273

61.8% retracement – 1.3210

78.6% retracement – 1.3122

Pattern Watch:

Still early in the correction — we remain open to complex structures forming (zigzag, double zigzag, flat, or triangle)

We’ll continue monitoring for structure confirmation as price unfolds. As always, patience is key when anticipating the end of a corrective phase. Traders should avoid premature entries and instead wait for a recognizable structure and supporting confluence.

For more detailed wave-based forecasts and real-time setups, explore our full library of Market Insights

Disclaimer:

Trading forex involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results. The information and signals provided on this website are for educational purposes only and should not be considered financial advice. You are solely responsible for your trading decisions and any resulting financial losses. Please consult with a licensed financial advisor before engaging in forex trading.

© 2025. All rights reserved.

Trading Resources: [Market Insights] [Elliott Wave Course] [Forex Signals Guide] Tools: [Economic Calendar ][Position Size Calculator] Support: [FAQ] [Contact] [New To Telegram?]